How to develop a killer concept without even spending one dollar

According to Crawford and Benedetto (2011), a product can be seen as a set of attributes. This entails that a product can be explained by citing its attributes. There are three kinds of attributes:

- Features: what the product consists of

- Functions: what the product does and how it works

- Benefits: the way a product provides satisfaction to the user

The conjoint analysis is a marketing tool, used in product repositioning and new product development applications (Wittink & Cattin, 1990). Conjoint Analysis estimates the customer’s preference into a set of different attributes (Green & Srinivasan, 1990).

Continue your reading if you like to know more about the conjoint analysis, and/or watch the video to get to know this powerful tool

Analytical attribute techniques enable the development of new product concepts by altering one or more of its current attributes, or by adding attributes, and to assess the desirability of these concepts. There is a range of quantitative and qualitative attribute analysis techniques available. Conjoint analysis is considered to be a quantitative technique.

What can a conjoint analysis do for you?

This technique can be used to develop high-potential concepts in the concept generation phase, but it’s also used in concept evaluation and even further along in the new products process (Crawford & Benedetto, 2011).

The conjoint analysis tool became popular as a research tool for commercial applications in a short time (Wittink et al, 1990). It is one of the most common analytical tools used to assess tradeoffs. It is furthermore used to analyze market needs and preferences, to segment the market according to the benefits sought and to test how well a concept will be accepted by the market (Crawford & Benedetto, 2011). It is considered as an early indicator of ultimate product success, at least for product line extensions. According to the survey of Mahjan and Wind (1991) the conjoint analysis is mainly used to improve ‘new products’ success. Participants from the survey indicate the conjoint analysis as the sixed most frequent used method. One limitation of this analysis is ‘the inability to capture the complexity of the market’. The conjoint analysis is considered to be a valued tool among managers within the new product development (Witting et. al, 1990).

Steps involved in a conjoint analysis

According to Green and Srinivasan, (1990), the conjoint analysis consists of six steps. Each step has an alternative method to conduct a conjoint analysis. The steps are included in table 1.

Table 1 Steps involved in conjoint analysis. Source: Green & Srinivasan, 1990

| Step | Alternative methods |

| 1. Preference model | Vector model, ideal point, part-worth function model, mixed model |

| 2. Data collection method | Full profile, two-attributes-at-a-time (tradeoff tables) |

| 3. Stimulus set construction | Fractional factorial design, random sampling from a multivariate distribution, Pareto-optimal design |

| 4. Stimulus presentation | Verbal description, paragraph description, pictorial or three-dimensional model representation, physical products. |

| 5. Measurement scale for the dependent variable | Rating scale, rank order, paired comparison, constant sum paired comparison, graded paired comparison. |

| 6. Estimation method | Metric methods (multiple regression), nonmetric (MONANOVA), choice probability based methods. |

Table 1 gives an overall picture of the steps involved in the conjoint analysis. Every step has different methods to conduct the analysis. Because of the large number of alternative methods, only the full-profile conjoint analysis, with specific choices of methods is explained.

Different types of conjoint analysis

The full-profile conjoint analysis is one for which information is obtained on all possible levels of all the product’s attributes. Shortcomings of this method are the complexity that it brings when there are too many attributes involved and that it does not measure the intercommunication among attributes.Adaptive conjoint analysis on the other hand shows only several attributes at a time to the respondent and readjusts to the respondent during the process. Another alternative is choice-based conjoint analysis, in which the respondent is shown a couple of different product choices and is asked which one is preferred (Crawford & Benedetto, 2011).

The conjoint analysis is a process whereby customers compare and evaluate a product based on their attributes or features. It is used to identify high potential gaps: combinations of attributes that (1) customers like and (2) are not on the market yet. It uses different regression analysis methods, e.g. monotone analysis of variance (MONANOVA), a data analysis technique to acquire patterns within the rank order data. The goal is to identify the customer’s underlying value system: which level of the key attributes are favored and which attributes are most valued (Crawford & Benedetto, 2011).

The result is insight to the levels of attributes that are preferred by customers and rank ordered the possible combinations from most to least preferred. Every combination could be seen as a concept. The top-ranking concept (or concepts) is the one that has the highest potential and should be considered for further development.

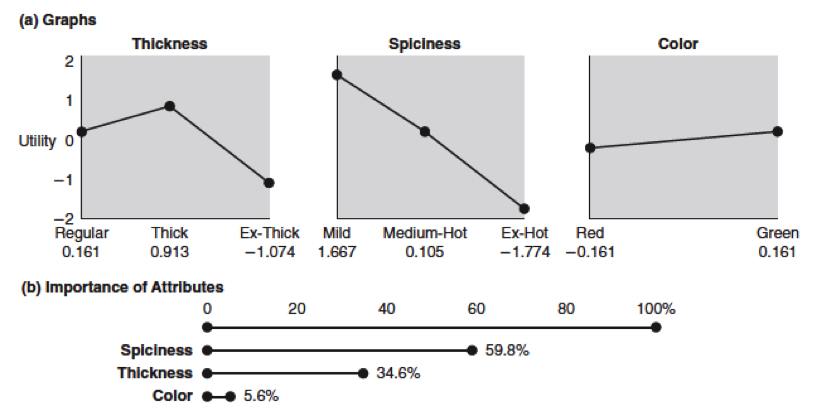

A graphical full-profile conjoint analysis output could look like figure 1a-b. The input came from a preference ranking of a respondent for a salsa consisting of three attributes: thickness (with three levels: Regular, Thick and Extra thick), spiciness (Mild, Medium-Hot and Extra-Hot) and color (with two levels: Red and Green). The best salsa would be a medium-thick, green, mild salsa in this case. Note that these are the levels of each attribute with the highest utilities in figure 1a.

Figure 1a illustrates a visual representation of the relative importance of the attributes. An attribute is considered to be more important than others when a large range in utilities is found. Therefore, spiciness is considered to be the most important attribute and color the least important. The graphical output illustrates also the level at which each attribute is favored. As illustrated, mild salsa is preferred over medium-hot or extra-hot, other attributes being equal. This specific customer also favors medium-thick salsa to both regular and extra-thick, and favors green salsa very slightly more than red salsa.

Figure 1b illustrates the relative importance of the three attributes as percentages. As can be seen, the relative importance of spiciness to this individual is nearly 60 per cent. The color (5.6%) of the salsa would not affect the choice of this person while thickness (34.6%) would.

Figure 1a Graphical view of a conjoint analysis result, figure 1b: importance of attributes. Source: Crawford & Benedetto, 2011

Practical decisions that need to be made while executing a conjoint analysis

There are four practical decisions that one has to make in the fieldwork for the conjoint analysis according to Crawford & Benedetto (2011).

- A product has to be specified as a bundle of attributes. This is more difficult done with products where its attributes may be more difficult for the respondent to articulate like a perfume.

- Determine the determinant attributes before the conjoint analysis is done. This can be realized with the help of AR gap mapping or one of the qualitative techniques.

- Select respondents who are familiar enough with the product category and the attributes to be able to provide significant data on preference. This means that new to-the-world products may not be suited for conjoint analyses.

- The firm should be able to develop the product that could deliver the combinations of attributes preferred in the conjoint analysis.

Tammy

Thank you for this report teaching the steps of Conjoint Analysis!! I am studying the market now and focusing on the local golf industry. I have a team from the Windsor University helping me with this and during this time I will try to conduct my own analysis to add to the overall findings!! SUPER READ and VERY EXCITED to give this a try!!

Best Regards,

Tammy Iwanicki

Entrepreneur

tam_psk@hotmail.com

admin

You are welcome! Let me know how it goes 🙂